Arizona, Mexico, and North America's "Auto Alley"

Arizona and Mexico are key partners in the now highly integrated North American vehicle production system

Understanding Arizona’s position with respect to Mexico’s automotive industry has become very important in light of current proposed changes to NAFTA and the U.S.-Mexico trade relationship. The automotive industry became the backbone of Mexico’s manufacturing sector in the 21st century, and more importantly, made Mexico a key partner in the now highly integrated North American vehicle production system. While not an "auto-manufacturing" state, Arizona has nevertheless become integrated into this system and experienced recent rapid growth in this high-value economic sector.

NAFTA as a Major Stimulus of Regional Integration

Cross-border integration in the automotive industry between the U.S, Canada, and Mexico started long before NAFTA was inaugurated in 1994. All three major U.S. car manufacturers, the Detroit-based “Big Three” – General Motors, Chrysler, and Ford Motor Company – had established car assembly plants in Mexico by 1980s.1 Chrysler opened its first car assembly plant in Toluca, State of Mexico, in 1968,2 and General Motors established its first modern car assembly plant in Ramos Arizpe, Coahuila, in 1981.3 Also in 1981, Ford Motor Company opened its first two plants in Mexico: one in Chihuahua, the capital of the border state of Chihuahua, and the other in Toluca, in central Mexico. Then in 1986, Ford built its plant in Hermosillo, Sonora. The latter, obviously due to its proximity, is of primary importance to Arizona’s economy.

Since the mid-1960s, the maquiladora program in Mexico in combination with special provisions in the U.S. tariff system allowed for duty-free import/export of U.S. manufactured parts assembled in Mexico and subsequently returned to parent companies in the U.S. Although the U.S.-owned car assembly plants were not officially part of Mexico’s maquiladora sector, they enjoyed similar benefits. These companies also greatly benefited from the maquiladora sector as an important supplier of parts and components. In 2006, the maquiladora sector and the auto industry in Mexico were combined with other export-oriented businesses to form a single program known under acronym IMMEX (Industria Manufacturera, Maquiladora y Servicios de Exportación).

NAFTA profoundly stimulated the automotive industry in Mexico, both car assembly and parts manufacturing plants. The Rule of Origin, one of the original six NAFTA provisions, in particular became attractive to Asian and European car manufacturers interested in access to the U.S. market by locating car assembly plants in Mexico. According to Rule of Origin, parts and components manufactured in Mexico (or in the U.S. or Canada for that matter) qualify as duty-free import/exports within NAFTA countries.

The latest surge in Mexico’s auto industry, however, is attributed largely to the economic downturn of 2008-2009 in the U.S. and the restructuring of the Big Three in lieu of declining sales volume and competition from foreign carmakers. According to Thomas Kleir and James Rubenstein - two experts on the North American auto industry 4 - lower Mexican labor costs more than offset the additional costs of shipping finished cars to the north. In addition, U.S. automakers can access other markets due to trade agreements that Mexico signed with numerous countries.

In this first piece, Arizona’s location is examined relative to Mexico’s automotive industry hubs. This, to a large degree, affects the volume and dollar value of automotive manufacturing products shipped to and from Mexico through Arizona’s border ports of entry.

Geography of the North American “Auto Alley”

Most of the North American motor vehicle industry is highly clustered in a region known as “auto alley." 5 This north-south-oriented auto region stretches from southern Ontario in Canada through the interior of the U.S. between the Great Lakes and the Gulf of Mexico. Although with less intensity, it extends south across the border and connects with central Mexico.

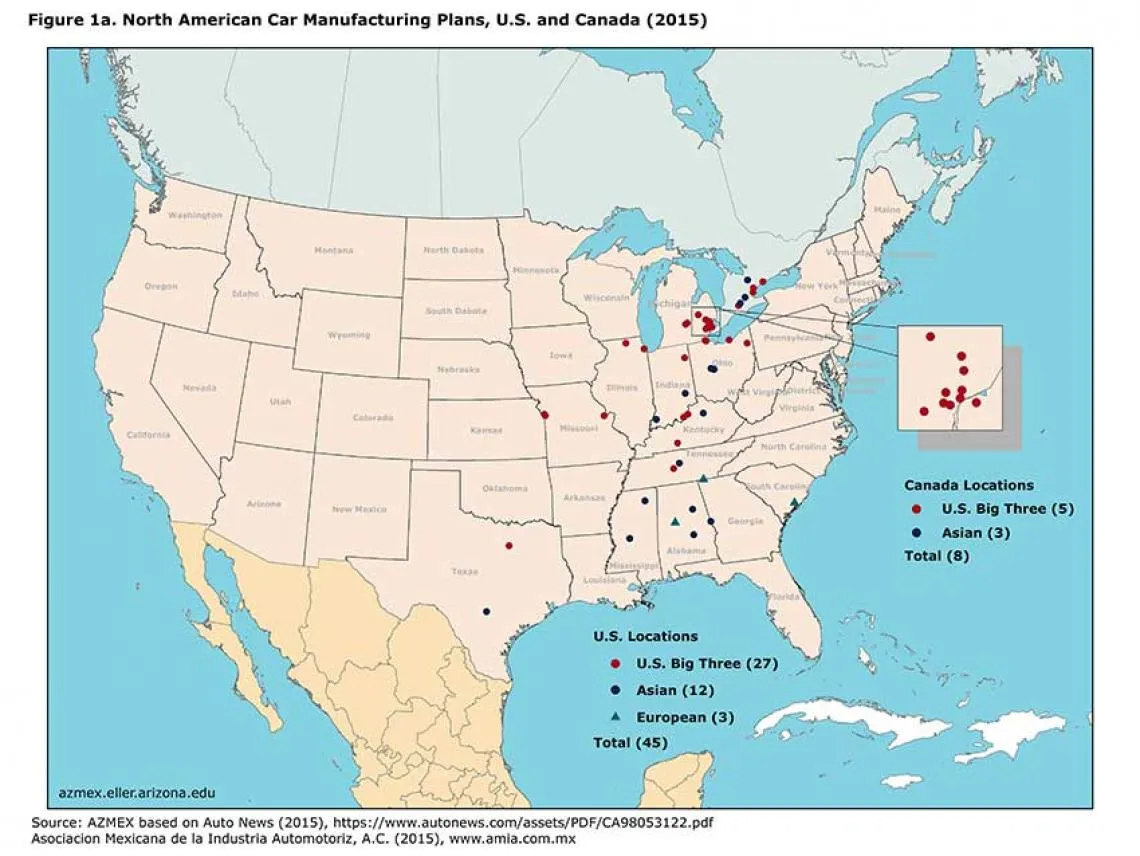

Car manufacturing in the U.S., including both the domestic and foreign owned companies, is concentrated in 13 out of the 48 contagious states (listed in order by number of plants): Michigan, Ohio, Alabama, Illinois, Kentucky, Tennessee, Indiana, Mississippi, Missouri, South Carolina, Texas, Georgia, and Kansas. The concentration in Michigan and adjacent states (including Ontario in Canada) reflects the industry’s historic base and the dominance of Detroit’s Big Three automakers - General Motors, Chrysler, and Ford Motor Company. Locations in Southern states of the U.S. reflect newer plants, mostly foreign-owned, attracted by lower labor costs, non-unionized labor, government incentives, as well as the proximity to Mexico (Figure 1a).

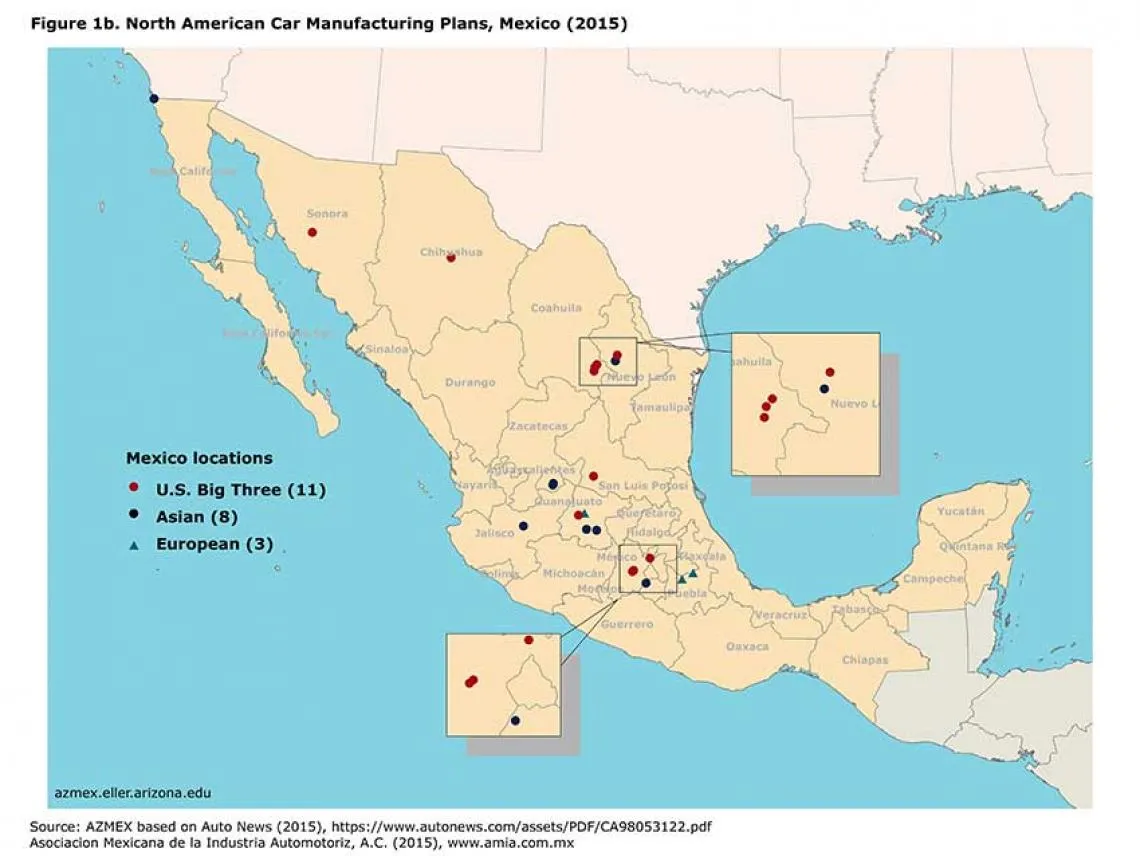

In Mexico, car manufacturing plants are concentrated in central Mexican states followed by locations in border states. Mexico’s locations reflect a combination of factors considered by foreign car manufacturers. The northern border states are favored because of their proximity to U.S. with regard to both automotive part suppliers and the U.S. market for finished cars. The supply of a skilled and stable labor force and access to the Mexican domestic market favors Mexico’s central states near Mexico City, the country’s largest consumer market (Figure 1b).

Figure 1a: North American Car Manufacturing Plants, U.S., and Canada (2015)

Source: AZMEX based on Auto News (2015) & Asociacion Mexicana de la Industria Automotoriz, A.C. (2015)

Source: AZMEX based on Auto News (2015) & Asociacion Mexicana de la Industria Automotoriz, A.C. (2015)

In terms of the number of assembly plants, the Big Three car manufacturing companies still dominate the North American auto industry. As of 2015, General Motors, Chrysler, and Ford Motor Company operated 43 plants, of which 27 car and truck assembly plants are located in the U.S., 11 in Mexico, and 5 in Canada.6

In addition to the U.S. automakers, major Asian and European car manufacturers now have a significant presence in the North American region. As of 2015, in the U.S. there were 18 car assembly plants operated by Asian (Honda, Nissan, Toyota, and Hyndai-Kia) and European companies (Mercedes-Benz and Volkswagen). In Mexico, Asian and European companies operated a total of 11 car assembly plants.

Auto parts suppliers – a critical component of the auto alley

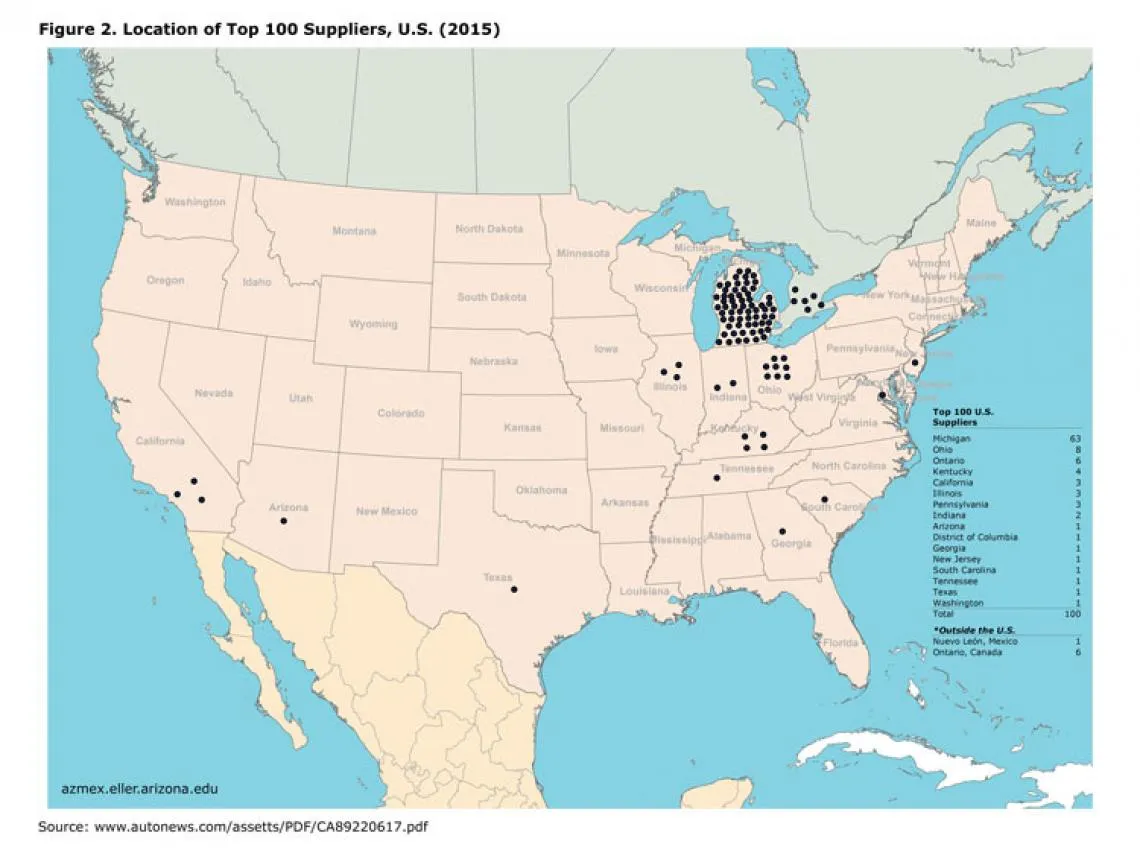

Of the top 100 auto parts suppliers to the North American auto industry almost two-thirds are headquartered in Michigan, six in adjacent Ontario in Canada, and the remaining one quarter in other U.S. states with car assembly plants (Ohio, Illinois, Kentucky, Indiana, Tennessee, Georgia, South Carolina, and Texas). Three suppliers in California and one in Arizona made the top 100 list in 2012. These “outliers” in the Southwest are obviously associated with car assembly plants in our neighboring border states of Baja California Norte, and Sonora. One of the 100 top suppliers was located in Nuevo León, Mexico (Figure 2).7

Figure 2: Headquarter Locations for Top 100 North American Motor Vehicle Parts Suppliers

Source: AZMEX based on Auto News (2013)

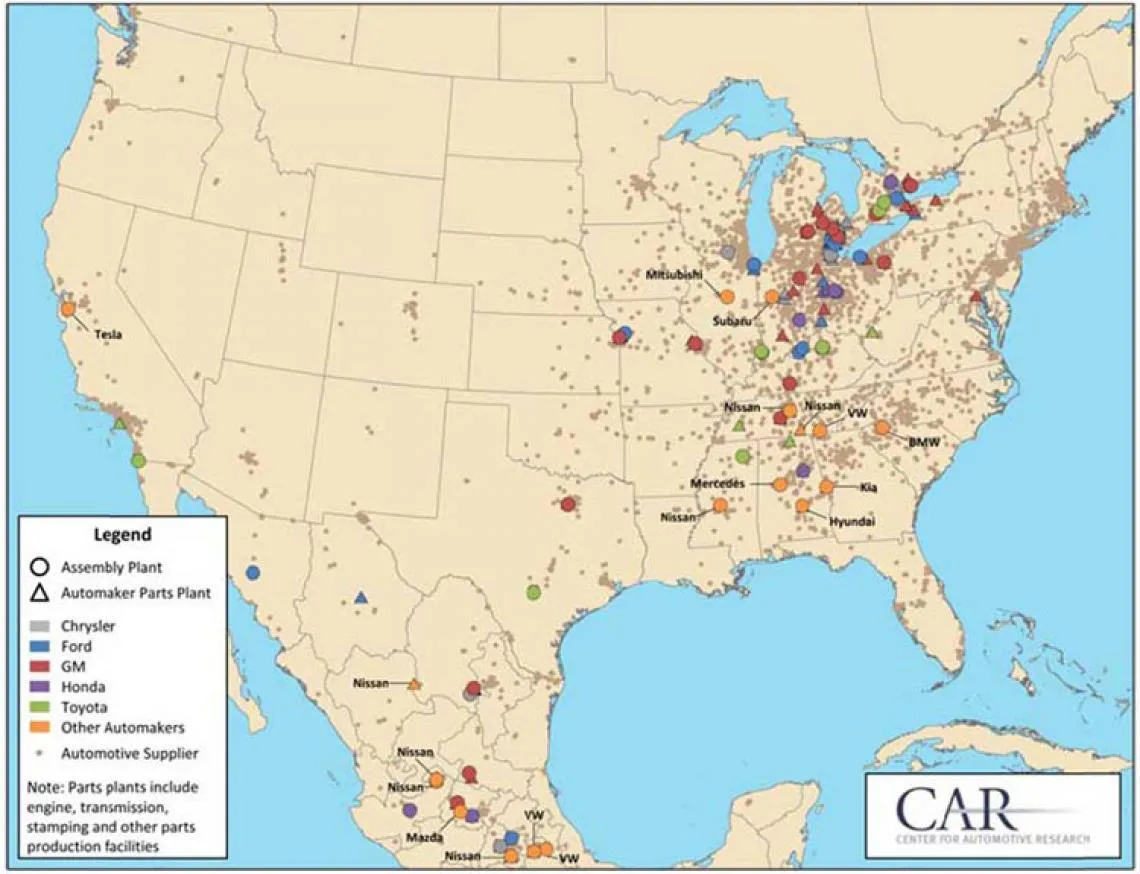

Each of these top 100 suppliers has multiple facilities producing motor vehicle parts. Their locations, as revealed in figure 3 , are closely correlated with locations of car assemblers resulting in a high concentration especially in the U.S. portion of auto alley.8

Figure 3: Location of Parts Producing Facilities in Relation to Assembly Plants

Source: Center for Automotive Research

The importance of just-in-time delivery in car manufacturing is a main reason for parts producers to locate close to assembly plants. In Mexico in particular, U.S. and foreign suppliers have located close to car assembly plants in order to minimize challenges presented by transportation infrastructure and/or border crossing delays. A multi-layered supplier tier system has been developed where tier-one suppliers sell directly to car assembly manufacturers, also known as OEMs (original equipment manufacturers); tier two suppliers sell directly to tier one suppliers, tier three suppliers to tier two, and so on.9

Whereas the automakers and tier-one suppliers tend to be among the biggest companies, industry analysts point out that there are myriad small businesses supplying a large and diverse number of products and services in the auto industry’s overall supply chain.

Arizona’s Position

Clearly, in terms of geographic location, Arizona is positioned outside of the North American “auto alley.” For that reason, the Ford Motor Company’s assembly plant in Sonora is a critical asset in the entire Arizona-Sonora region. For Arizona, it presents opportunities for both Arizona’s companies and Arizona’s border ports of entry to participate in and benefit from automotive trade with Mexico.

To learn more about Arizona’s trade with Mexico in automotive products, one of the fastest-growing cross-border commodities in the last few years, and what might be at stake if new policies disrupt the current commodity flows, read Professor Pavlakovich-Kochi's other articles on this important topic:

[1] In fact, both General Motors and Chrysler started car production in Mexico in the 1930s with main purpose of selling on Mexican market.

[2] Toluca Car Assembly (2017) , Wikipedia.org. Retrieved February 24, 2017

[3] Ramos Arizpe Assembly (2017) , Wikipedia.org. Retrieved February 24, 2017

[4] Thomas Klier, a senior economist and research advisor, Federal Reserve Bank of Chicago; James Rubenstein, Professor, Department of Geography, Miami University.

[5] Klier Thomas and James Rubinstein, The Changing Geography of North American Notor Vehicle Production , Cambridge Journal of Regions, Economy and Society , 2010, 3(3): 335-347.

[6] Based on Auto News (2015) in combination with Asociación Mexicana de la Industría Automotoriz, A.C.

[7] Source: Auto News Data Center (2015)

[8] Thomas Klier and James Rubinstein, Configuration of the American and European auto industries – a comparison of trends , Presented at 19 th GERPISA colloquium, 2008.

[9] Linda Abbruzzese and Curt Cultice, Export Advice: Doing Business in Mexico’s Automotive Industry , 2016