Arizona’s Trade with Mexico in Automotive Products: How Does Arizona Differ from the Nation?

In this second installment in our series of articles examining Arizona’s position vis-à-vis the Mexican automotive industry, attention is focused on Arizona’s trade with Mexico. Specifically, by examining Arizona’s exports and imports to and from Mexico in comparison with U.S. averages, insights can be gained into the degree to which Arizona’s manufacturing sector is integrated into the North American automotive production system. Results point to untapped opportunities for expansion in this arena for Arizona, as well as, shed light on possible impacts to Arizona’s economy if changes are imposed on the NAFTA framework. Given the degree of trans-border integration in the automotive industry among the three NAFTA partner countries, any changes affecting the automotive industry directly will likely impact a whole array of supporting industries.

Tracing Automotive Manufacturing Products in Trade Data

Statistically, automotive manufacturing encompasses three main subdivisions: (1) motor vehicles manufacturing, (2) motor vehicles bodies and trailers, and (3) motor vehicle parts manufacturing. In the North American Industry Classification System (NAICS) this corresponds to industry groups 3361, 3362, and 3363, respectively (Figure 1).

Figure 1. Automotive Manufacturing Industries in the North American Industry Classification System (NAICS)

U.S. trade statistics monitor the import and export of commodities in substantial detail. However, data are gathered and presented according to the Harmonized System (HS) which is based on classification of goods, not industries. In order to analyze Arizona’s trade in automotive products based on industry classification (as illustrated in Figure 1), the AZMEX team used a conversion technique to reclassify imports and exports by commodity into imports and exports by NAICS industry. This allows us to analyze the impacts of changes in trade patterns on employment in the US and Arizona by industry sector.

Increasing Importance of Arizona’s Automotive Exports

Arizona, as discussed in our previous article "Arizona and North America's Auto Alley", is geographically outside the North American “auto alley,” but this does not mean that Arizona does not participate in the North American auto production system. Quite the contrary: Arizona’s proximity to Ford Motor Co. in Sonora and the surrounding industrial complex, which is itself composed of multiple tiers of suppliers, is of great importance to Arizona’s economic ties with the Mexican automotive sector. There is a vast and varied array of parts and components that vehicle assembly plants outsource from a variety of manufacturing industries, such as gasoline engine and engine parts; electrical and electronic equipment; steering and suspension components; brake systems; transmission and power train parts; seating and interior trimmings; metal stamping, and other motor vehicle parts.1

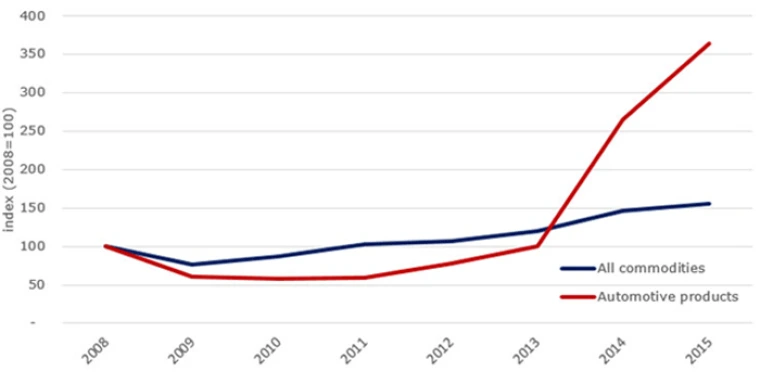

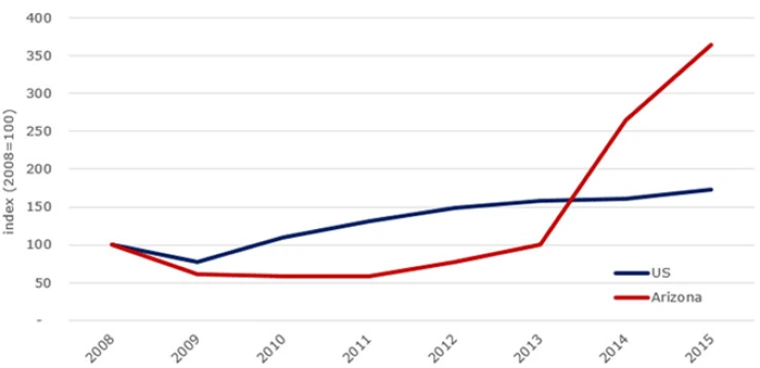

Since 2013, the export of automotive manufacturing products to Mexico has been one of Arizona’s shining stars. Arizona’s automotive exports to Mexico increased from $153.3 million in 2008 to $571.9 million in 2015, an impressive 264% increase over just 8 years. Exports of automotive products to Mexico surpassed growth for all Arizona’s exports to Mexico, which increased at a much slower rate of 55% during the same 2008-2015 period (Figure 2).

Figure 2. Arizona Exports to Mexico (2008=100)

Source: AZMEX based on USA Trade Online

Arizona is Less Dependent on Mexico’s Automotive Industry than the National Economy

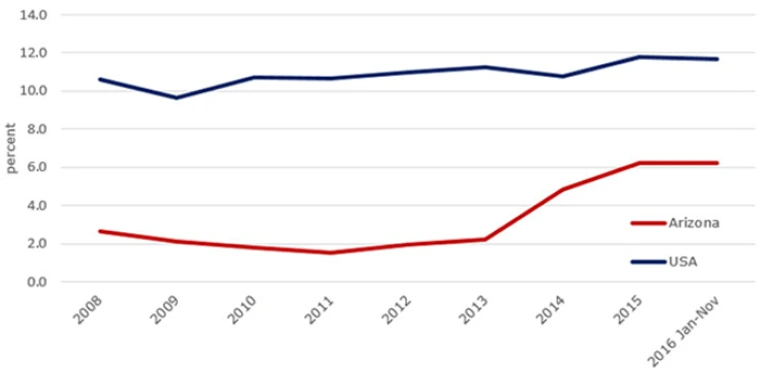

Automotive products account for smaller percentage shares in Arizona’s trade with Mexico compared to the nation overall. The next three charts illustrate the relative importance of automotive products with respect to Arizona’s exports, imports, and total trade.

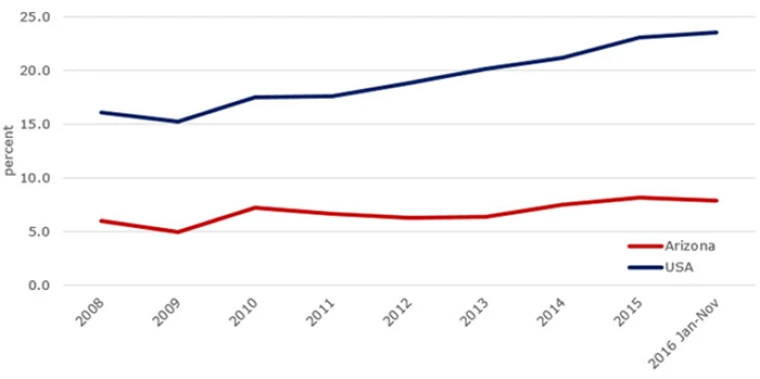

In 2015, Arizona’s $571.9 million in exports of automotive products to Mexico accounted for 6.2% of Arizona’s total $9.2 billion worth of exports to Mexico that year. In comparison, automotive products accounted for almost twice that percentage of total U.S. exports to Mexico, 11.8% in 2015. For both Arizona and the U.S., this upward trend continued through November 2016 reaching the highest percent shares since 2008 (Figure 3).

Figure 3. Automotive Products as a Percent of Total Exports to Mexico

Source: AZMEX based on USA Trade Online

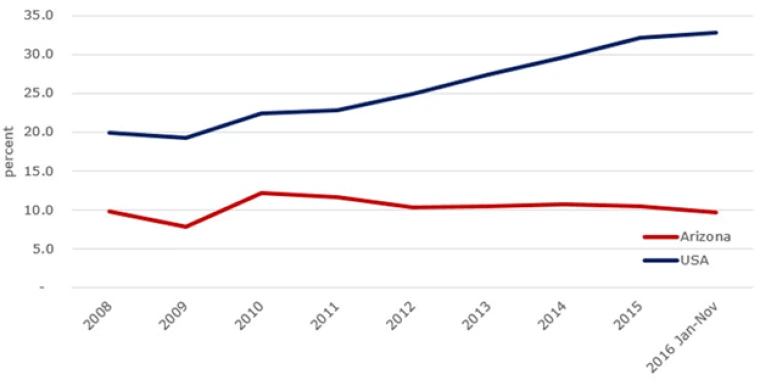

For both the Arizona and U.S. economies, automotive manufacturing products comprise a larger share of imports than they do of exports with respect to Mexico. This phenomenon partially reflects the value added in Mexican car assembly plants and an overall higher value-added to completed cars than the value added to individual automotive parts. In 2015 Arizona imported $802.2 million worth of automotive products, or 10.5% of all imported commodities, from Mexico. By comparison, automotive products accounted for 32.1% of total U.S. imports from Mexico. While the same trend continued for U.S. through November 2016, in Arizona’s case the value of other commodities imported from Mexico slightly reduced the relative importance of automotive products in total imports (Figure 4).

Figure 4. Automotive Products as a Percent of Total Imports from Mexico

Source: AZMEX based on USA Trade Online

Of Arizona’s total trade with Mexico, about 8% is directly related to automotive manufacturing products. The relative importance of automotive products has increased from 6.0% in 2008 to 8.2% in 2015. A slight decline occurred in 2016 (January-November) as the value of other commodities grew faster. Mexico automotive products accounted for 23.1% of U.S. trade with Mexico in 2015, with this trend continuing through November 2016 (Figure 5).

Figure 5. Automotive manufacturing products as % of total trade with Mexico

Source: AZMEX based on USA Trade Online

Arizona’s Exports of Automotive Manufacturing Products Grew Faster than the National Average

Whereas automotive exports to Mexico accounted for a smaller share of Arizona’s total exports to Mexico, Arizona experienced much faster growth in this sector than the nation as a whole. Even with a rather shaky start after the Great Recession, Arizona’s automotive exports have soared and by 2015 exceeded their 2008 level by 254%. By comparison, in 2015, U.S. exports to Mexico were 55% above their 2008 level (Figure 6).

Figure 6. Exports to Mexico of automotive products (2008=100)

Source: AZMEX based on USA Trade Online

Arizona and Mexico’s Automotive Industry: for Better or Worse

Opportunities to participate in Mexico’s automotive industry supply chain have proven to be an important stimulus to Arizona’s export of auto parts, and thus to Arizona’s economy as a whole. The expansion of Ford Motor Co. in Sonora has proven especially beneficial for Arizona’s manufacturing and distribution of auto parts. Arizona’s trade in automotive products with Mexico accounts for an overall smaller share of its total exports than is true for the nation overall, and certainly when compared to heavy automotive parts exporting states like Michigan. Until recently these circumstances have been interpreted as a window of opportunity for further expansion of the state’s exports. Increases in exports, especially manufacturing exports that are generally associated with higher wages, have traditionally been promoted by regional economic developers as a favorable approach to growing the state’s economy.

Questions are often raised as to why Arizona has historically not participated in Mexico’s automotive production to an even higher degree based on its proximity and easy access to Mexico. As our nation anticipates dramatic changes to NAFTA, should we be glad that percentage-wise Arizona is less dependent than other states and the nation as whole on trade in the automotive manufacturing sector? Or are we contemplating the possible loss of a vibrant, high-value, and rapidly expanding export opportunity for Arizona?

1. In the NAICS system, these correspond to industries under 33631, 33632, 33633, 33634, 33635, 33636, 33637, and 33639.

2. Automotive products consist of motor vehicles (NAICS 3361), motor vehicle bodies & trailers (3362), and motor vehicle parts (3363).